Money Management: How To Control Overspending

Posted by

Milan at 12.16.2009

|

Share this post:

|

Needless to say, a person is over excited, full of joyous mood while on holidays. This leads to the most common mistake- Overspending. I bet your joyous mood thaws when you sit back and calculate the amount spent after holidays. Overspending is obvious consequence when you have credit card with you. It is rather easier to spend money with credit card as you don't see physical money exchange. You would probably think twice to purchase an item for 300 bucks if needed to make cash payment or, you would do it easily with credit card otherwise.

What is the way out?

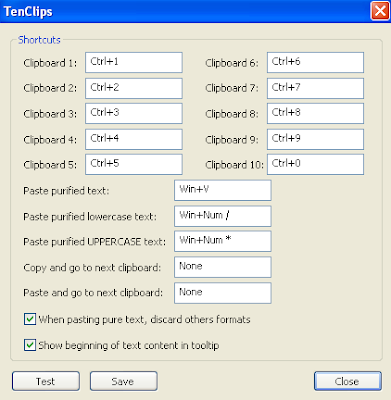

Pre paid credit cards is way better solution to avoid running in overspent-holidays-aftermath situation. Unlike conventional credit card (which allocates the amount you don't have in account), pre paid credit card works by allowing to spend the amount which you have deposited in account. While it enables to do everything one can do with credit card it also reminds you the spending limit every time you make transaction.

Pre paid card is something you should get around with but, it’s not just enough, it's not complete solution. Planning holidays and other expenses right from the beginning of New Year is very important to set platform for better financial year. Moreover Christmas Eve is around the corner. Ostensibly we are all over excited. Groceries stores have started discount schemes, Mannequins out side the cloth stores are being setup in Santa getup. Commercials have started bombarding us with invigorating slogans furnished with marketing tricks. With all that going around we need to make sure that we are not being drawn in emotions.

Do This

Make a list of holidays and expenses throughout the year

Figure out your annual income

Keep some amount aside for emergency

Set maxium amount to be spent for each occasion

Get pre paid credit card

Deposite the set amount for the occasion

And at the last enjoy!!!!

Add to Google

Add to Google